|

<< Click to Display Table of Contents >> Competitive Markets |

|

|

<< Click to Display Table of Contents >> Competitive Markets |

|

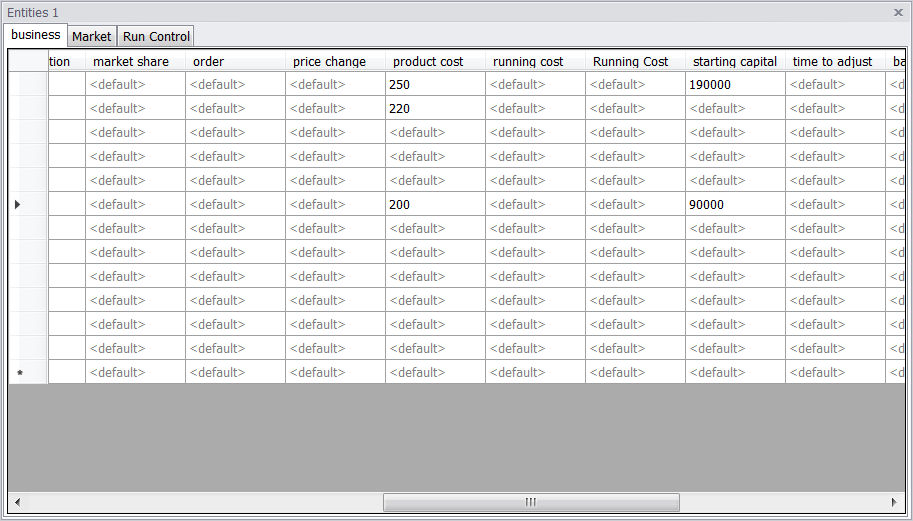

The Business18 model, by Lee Jones of Ventana Systems, UK, creates many new businesses which compete against each other on price, in markets where few survive and fewer thrive. It demonstrates in a simple context how two different entity types interact, and how create and delete actions can be used to simulate ongoing evolution of a market.

The model includes market entities and business entities.

•Each market entity calculates a daily demand level for widgets, which grows faster when prices offered by businesses in the market are lower. When the average of the demand seen by each business in the market exceeds a threshold, a new business is created and enters the market.

•Each business operates in a single market and competes entirely on price. Each business chooses its own level of markup over the average price in the market, and decides on the amount of inventory coverage it wishes to carry. These two decisions determine the business' market share (and thus sales and revenue) and stock orders (and thus costs) respectively. Bank balance grows or shrinks accordingly, and depending on initial capital, the business may run out of cash. When bank balance falls below a threshold, bankruptcy is triggered. The business exits the market---and the model.

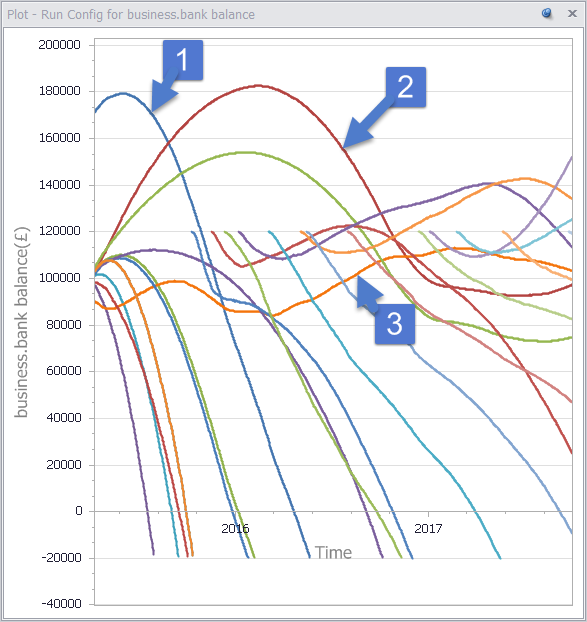

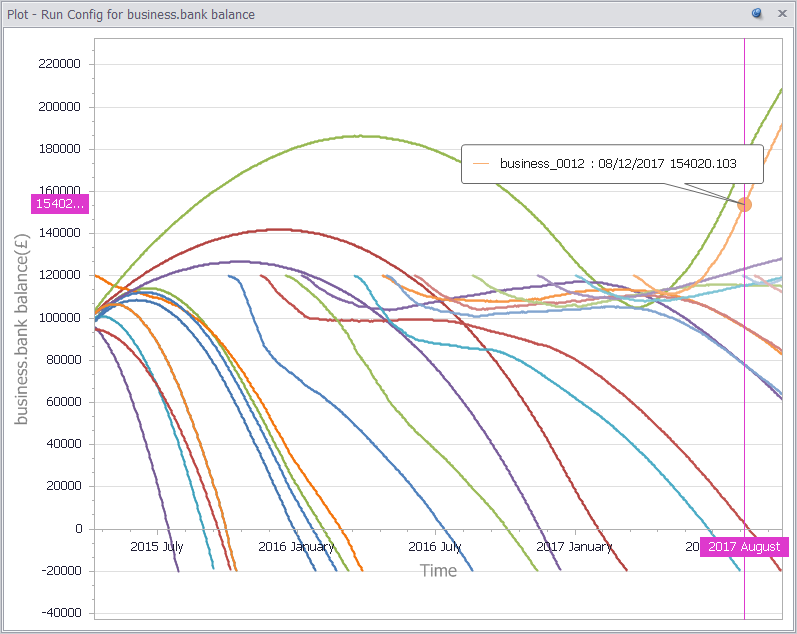

Results are shown below, through the lens of the bank balances of all the businesses. Many rise initially but only those who manage to keep prices down and still turn a profit manage to eventually run away with the market.

Which results in the smaller companies, in spite of their lower capital, consistently outperforming their competitors early on--and of the company with higher prices but much more starting capital quickly going bankrupt after slight initial success.